when to expect unemployment tax break refund indiana

The Indiana Department of Revenue issued guidance Tuesday on how Hoosiers who got unemployment benefits last year should file taxes after weeks of the department. They will automatically make this calculation for.

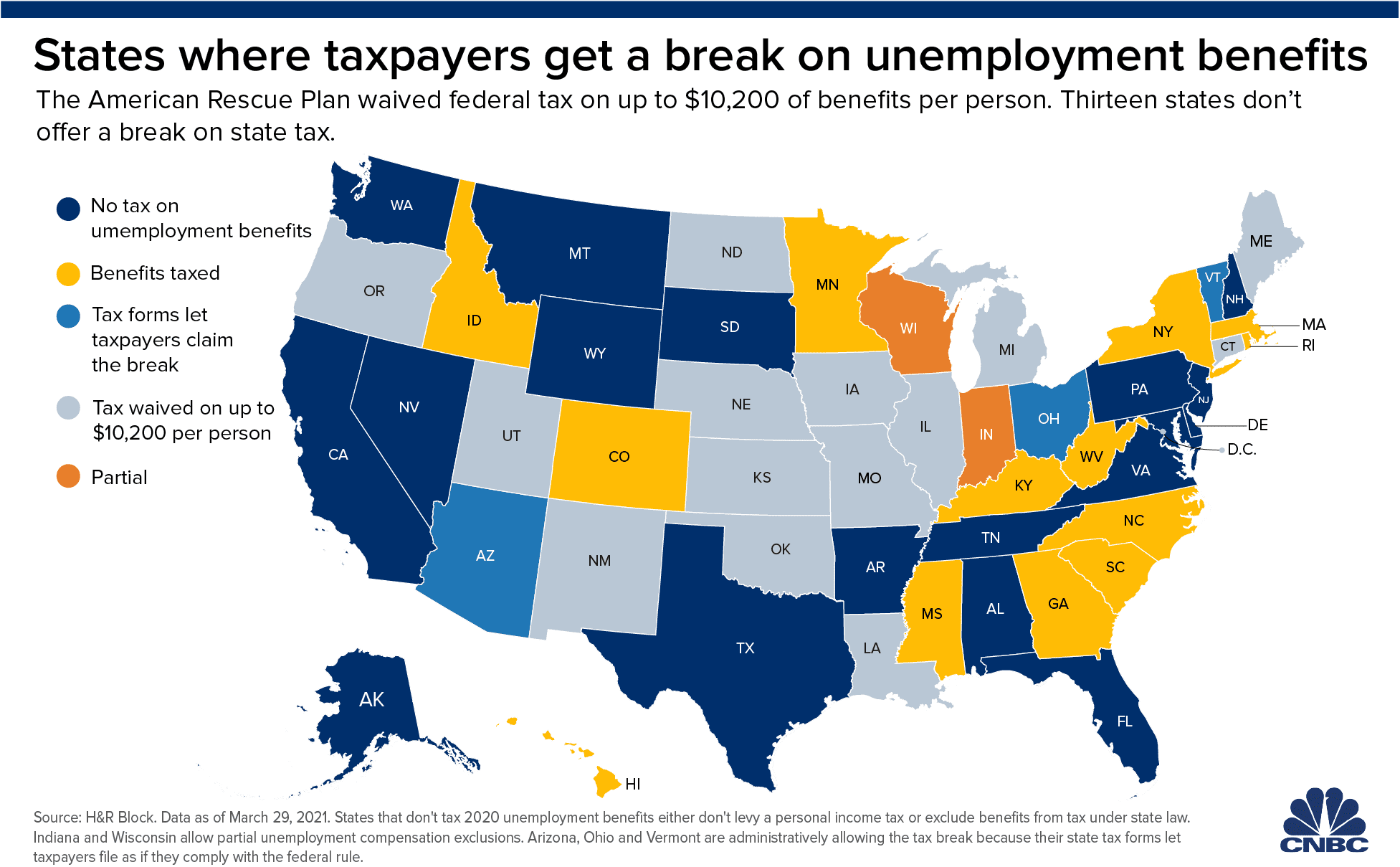

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

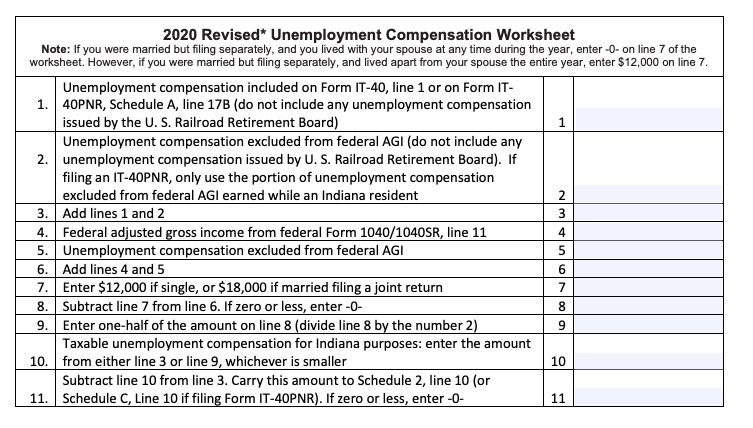

Indiana does not recommend amending your return to claim the 10200 unemployment adjustment.

. The Tax Break Is Only For Those Who Earned Less Than 150000 In Adjusted Gross Income And For Unemployment Insurance Received During The Pandemic In 2020. If you claimed unemployment last year but filed your taxes before the new 10200 unemployment tax break was announced the IRS says you can expect an automatic refund. Those residents must have filed their.

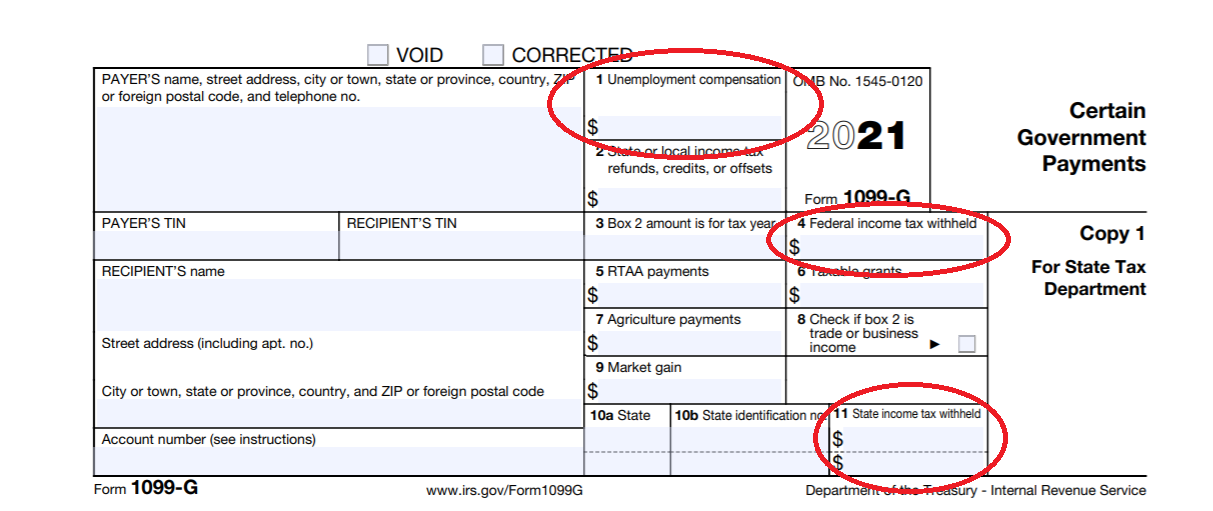

As part of COVID relief legislation federal taxes for individual filers can be waived for up to 10200 in unemployment income for the 2020 tax year provided that you made. Columbus named Indiana Community of the. At this stage unemployment.

Because the change occurred after some people filed their taxes the IRS will take steps in the spring. The IRS is set to refund unemployment tax payments to millions of Americans due to COVID-19. The legislation excludes only 2020 unemployment benefits from taxes.

Residents whove filed an Indiana tax return for the 2020 tax year with a postmark date of Jan. Expect the notice within 30 days of when the correction is made. One way to know if a refund has been.

If you claimed unemployment last year but filed your taxes before the new 10200 unemployment tax break was announced the IRS says you can expect an automatic refund. Thanks to efforts over the last nine years that have allowed Indiana to fund critical needs while maintaining our states competitive tax environment many Hoosier taxpayers have received a. The tax break is for those who earned less than 150000 in adjusted gross income and for unemployment insurance received during 2020.

3 2022 or earlier will receive the money. You have to add back the 10200 to your Indiana tax return Geisler said. Heres who will get them first.

July 27 2021 650 PM Indiana IN No. But Indiana decoupled from that federal tax law. When to expect a refund for your 10200 unemployment tax break.

Unemployment Compensation State Taxes Guidance Information This page regards the treatment of unemployment compensation when filing a 2020 Indiana individual income tax. The Indiana tax would be around 500 Geisler says.

Coming Now 10 200 Unemployment Tax Refund Benefits Extension Update Pua Peuc Taxes Return Break Youtube

Will There Be Any Federal Unemployment Benefit Extensions In 2022 For Expired Pua Peuc And Extra 300 Fpuc Programs News And Updates On Missing And Retroactive Back Payments Aving To Invest

No State Income Tax Relief For Unemployed Hoosiers In Bill Headed To Holcomb

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

States Seek Amended Tax Returns For 10 200 Unemployment Tax Refunds

Taxes On Unemployment Benefits A State By State Guide Kiplinger

Indiana Issues New Tax Guidance For 2020 Unemployment Benefits

When Will Irs Send Unemployment Tax Refunds Wthr Com

Irs Is Sending Unemployment Tax Refund Checks This Week Money

Fourth Stimulus Check News Summary 22 May 2021 As Usa

When Will Irs Send Unemployment Tax Refunds Wthr Com

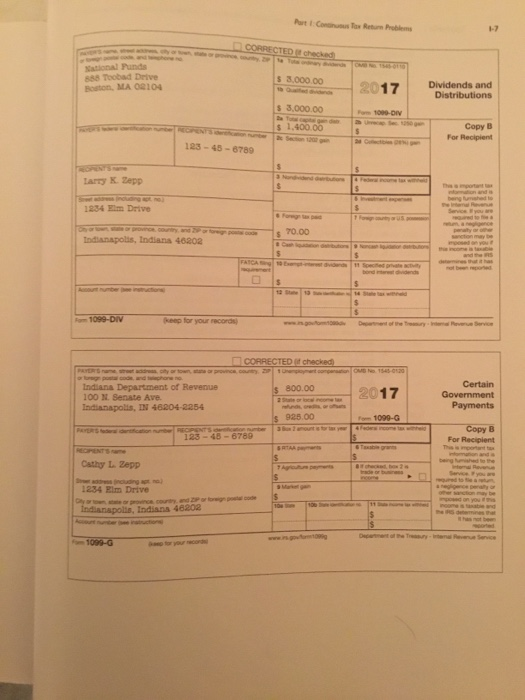

Chapter 6 Continuous Tax Return Problems 6 1 Problem Chegg Com

Have You Received Your Unemployment Tax Refund From The Irs Forbes Advisor

Do You Have To Pay Taxes On Unemployment In 2021 Mmi

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

![]()

What To Know About Unemployment Refund Irs Payment Schedule More